This is one of the rare, good news in the taxation in Brazil. Despite of the fact that the complexity of Brazilian taxation is being dealt with by the present administration, the total burden of taxation was not.

President Jair Bolsonaro, edited Decree No. 10,979 of 2022, reducing the IPI (Tax on Industrialized Products, or Federal VAT) rates by up to 25%. The IPI reduction takes effect from the date of the publication in the Official Gazzette, or February 25th 2022. Those are rare news, mainly due to the difficulties imposed on the Federal Government (and any other level of government – States and Counties) by the “Fiscal Responsibility Act” regulations in force. The measure was only possible due to the high federal collection, which in January 2022 totaled R$ 235.3 billion, a record amount, being 18.30% higher than the same month of 2021, inflation of the period already discounted.

The purpose of the measure is to encourage the recovery of the economy, hurt by the pandemic and an internal “war” between Executive, Legislative and Supreme Court. With the proportional reduction of the IPI rates, it is believed that an increase in productivity in the several areas of the manufacturing sector, seeking more efficiency in the use of productive resources, will take place. In fact, for years these products, which had a great impact on the price chain and, as a result, on employment levels in the country, were the object of criticism from the sectors involved. The measure, therefore, comes at a good time for the economy, and certainly constitutes an electoral wildcard thrown by the current president in the upcoming electoral disputes.

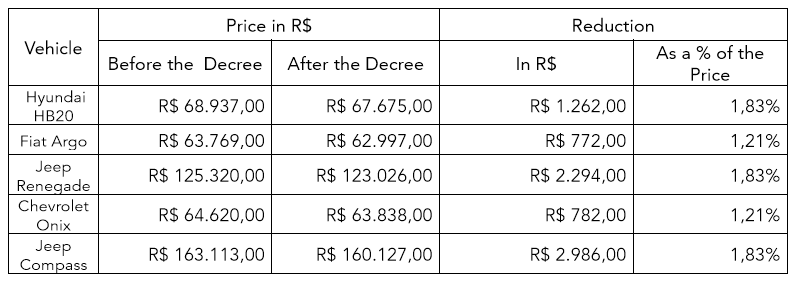

The decree establishes for a percentage of 18.5% of IPI to be collected in items such as passenger cars and other passengers’ vehicles. As an example, we list the five best-selling cars in 2021 (according to an article published on the G1 portal), detailing their price charged before and after the IPI reduction

It is important to note that in the above calculations, only the IPI reduction was taken into consideration. No considerations on variation of prices, inflation, market conditions, and other drivers were considered, which affect vehicle prices.

As we can see, although the reduction minimally affects the final price of the vehicles, it can be considered a good sign, and the final consumer is of course pleased. No harmful or hazardous products, such as liquor and tobacco were contemplated in the reduction list.

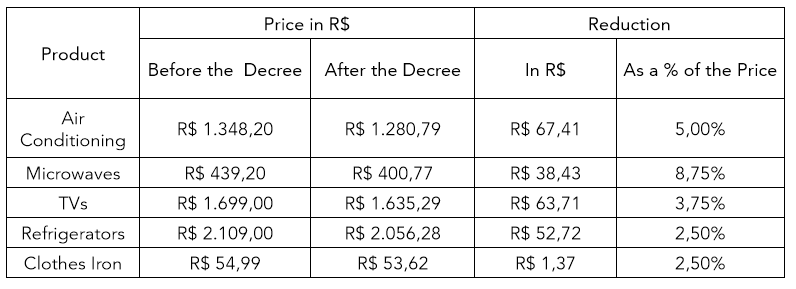

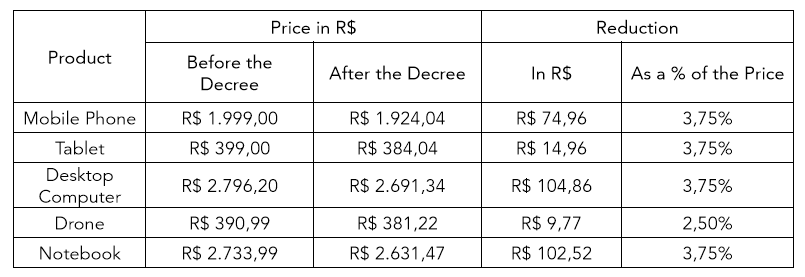

We list below several products of different segments, detailing how the IPI reduction affects the products.

Home Appliances

Electronics:

A more significant reduction can be seen above.

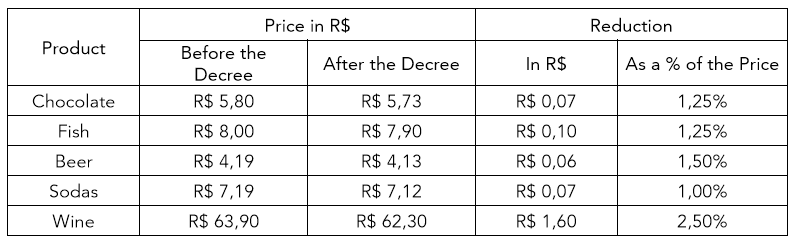

Food:

Because nobody`s made of steel.

For the food segment, we brought some products that are not so essential for consumption, as the IPI follows the constitutional principle of essentiality, that is, the essential product will be taxed at 0% or it will not be taxed.

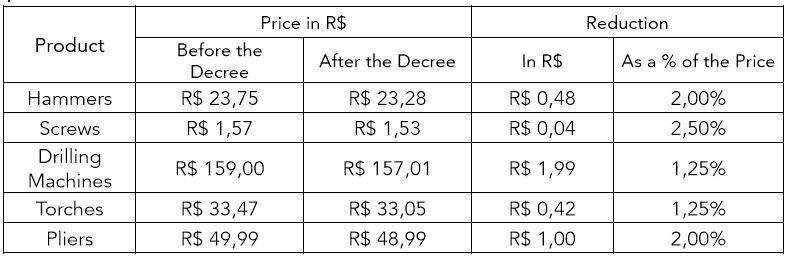

Tools:

We can see that the final impact on certain products reach up to 8.75% or more, and that for some products the reduction is around 1% to 2%. The effective reduction in the price of each product depends on the percentage of the original IPI rate.

The reduction of the IPI results in the purchase price by the consumer, since the IPI is a tax calculated “outside-in”, that is, the IPI value is added to the value of the product itself, to compose the total value, representing, in practice, a “taxation on the tax itself”. All industrialized goods will ultimately show a certain level of reduction in the IPI and the final prices to the consumer. The same applies to imports, given that the IPI is charged upon customs clearance of the imported items.

Such a reduction can help to reduce inflation, which was considerably increased in the COVID-19 pandemic, but a company may not pass on the discount of the IPI reduction, continuing with the price practiced, to increase its margin, as is just natural in certain segments. We have seen, notwithstanding, a peer-pressure on the production chain that may ultimately lead to a reduction in the consumer price levels.

According to the Ministry of Economy, the reduction of IPI rates will directly affect around 300 thousand industrial companies. In the long term, the reduction of the IPI is a measure that affects the reduction of collection, and that can force the government to cut public spending – or alternatively, as is expected, increase the consumption and therefore, the collection levels themselves – Laffer Curve in practice.

The reduction measure already generates expectations for the Tax Reform. The reduction directly affects the consumer, relieving private pockets during high inflation periods such as the present, given that there are still expectations of an increase in the prices of some products due to the crisis in Ukraine.

The reduction of the IPI is an advance for the industry, taking into account that the taxes paid by the industry, in relation to the national tax burden, are higher than its participation in the GDP.

Most important of all, however, is the signal that the eventual budget space can (and in our opinion should) be used to reduce the overall tax burden. It may not seem like much, but during the years of large primary surpluses, especially between 2002 and 2008, nothing was done in this regard. On the contrary, instead of granting the economy some level of tax relief, the surplus was used to provide successive increases in costs with the administrative machinery, mainly through the mass hiring of public servants.

If the pattern is maintained, and eventual budgetary spaces are used in a similar way, we will be facing an important trend reversal, which could have exceptional long-term aspects for the economy.