A huge portion of the companies that came to Brazil during the “golden years” (2002-2011) were service companies, mainly web-based operations. In a general manner, they pay ISS, or Tax on Services. This tax is regulated by one basic text – Complementary Law LC 116, but thousands of different county-level legislation (where it is levied).

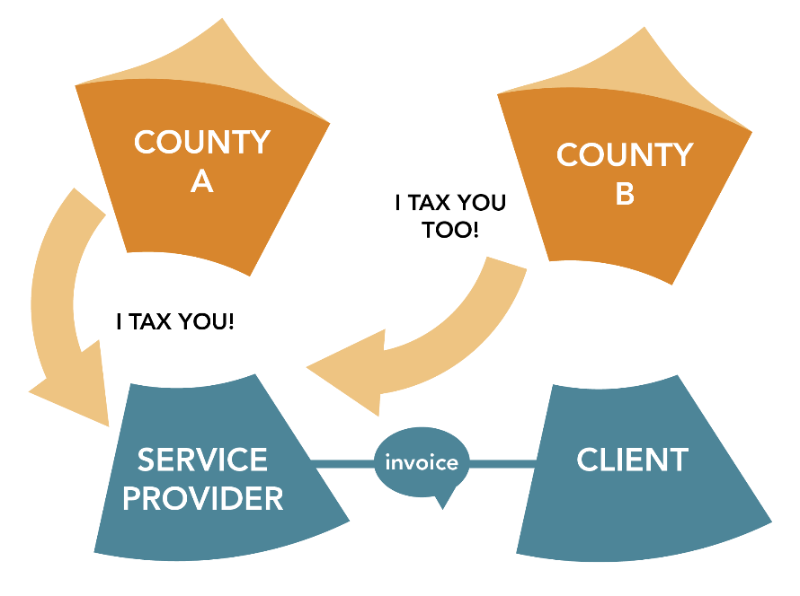

Brazil is a continent-nation with 5.570 counties, each with its own Tax on Services Legislation. Problem here is that some counties like to interpret the ISS law at their own largesse. Let`s see the following graphic:

Why is that? Because there is a dubiety in the text of the Law LC 116 that allows both counties (where the service provider is located and the one it is actually providing services) to charge ISS – here`s the problem – “It is considered as service providing location that where the taxpayer develop its activity in a temporary way” (Art. 4 of the Law). Therefore, the practical matter is that services providers in Brazil, depending on the nature of the activities developed, may be charged by two different counties. That is a recurring problem for many services that in practice are not provided “here” or “there”. Sometimes it happens both “here and there”, sometimes “everywhere” (and I`d risk to say, sometimes – “nowhere” – in the cloud, for example). One of my own activities, audit, is a perfect example.

I do not encourage anyone to cheat on taxes. To Caesar what is Caesar`s… But frankly, I`d like the legislators to make up their minds (or the tax courts for that matter) and define where do I pay the notorious ISS. But paying it twice (and being fined on this) is horrible!

So, if you are a service provider coming to Brazil, be prepared:

- Study you “main legislation” (the county where you plan to have your firm) carefully, comparing it to your activity – As much as feasible, know the county`s legislation – outside of the capitals, it tends to be pretty much alike, except for the incentivized activities (Counties incentivize some areas they want to attract service providers – some counties are real “tax havens”);

- Be on the safe side – if in doubt, be prepared to have a secondary taxpayer number in the county where you are “supposedly” providing your services;

Brazil has been said for many as a country “not for amateurs”. It is possible to make a handsome profit here, and fulfill the baroque legislation. But it takes time and sound advice.

Wesley Figueira

Managing Partner at Valuconcept